By Tom Ewing

In this month’s column I planned to focus on subcontracting. If you’ve been looking into some of the contracting advisory websites that I’ve referenced over the past few months you, too, likely noticed comments from many experts that working first as a subcontractor is a great way to break into the field of government contracts.

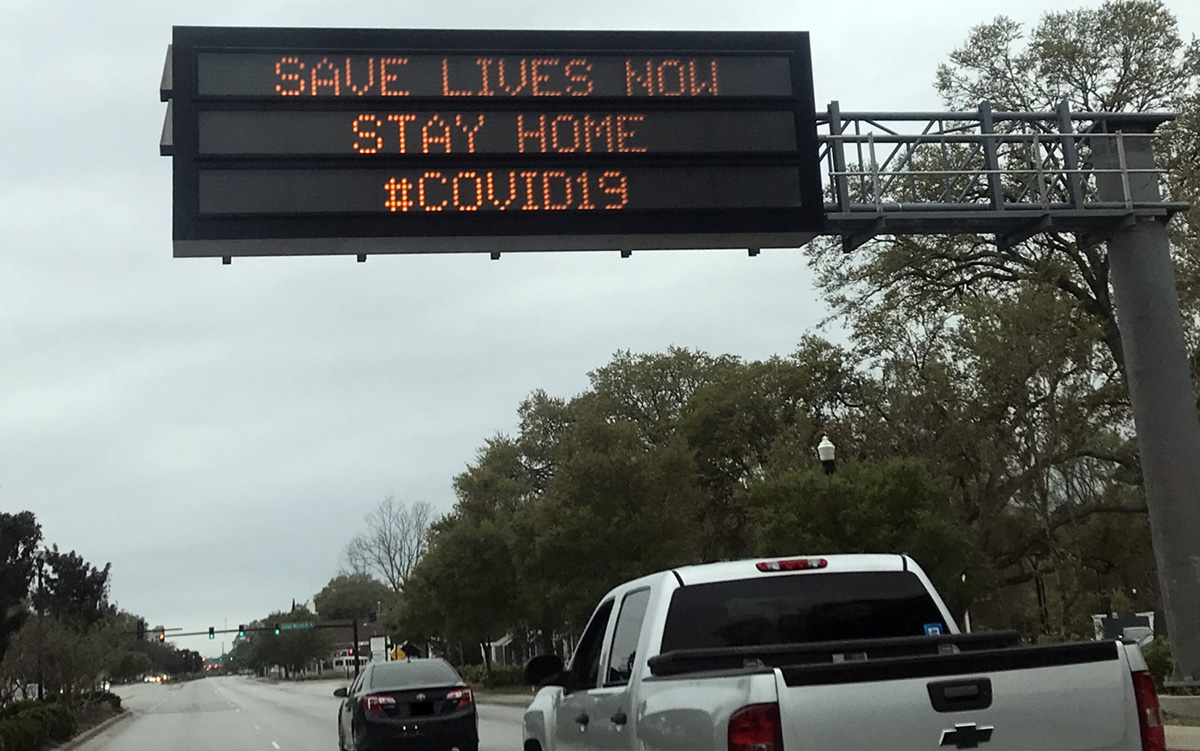

But that topic is postponed because there’s only one business issue at the end of March 2020: COVID-19. Maritime transportation workers, port workers, mariners and equipment operators, are included as essential workers within the Department of Homeland Security’s “Guidance on the Essential Critical Infrastructure Workforce.” It’s nice to be judged essential, of course, but it doesn’t have much meaning if no one needs your services, and the economy is crumbling all around you. Hopefully you’re not at that dire point.

However, if a slowdown (or worse) is staring you in the face, now is the time to take a close look at emerging federal business aid programs. On March 28 Congress passed the $2.2 trillion relief bill – the “Coronavirus Aid, Relief, and Economic Security Act’’ or the ‘‘CARES Act’’ (HR 748) – immediately signed by President Trump. Importantly, for businesses, this assistance will likely be quick because much of the funding (at least for businesses) is directed through existing programs such as Section 7(a) of the Small Business Act, familiar to many businesses, and, importantly, to banks and lenders. This is big money; the CARES Act increases Section 7(a) funds by $349 billion.

Importantly, the CARES Act designates the Small Business Administration (SBA) as lead agency for the new business loan programs.

SBA has been current and timely with COVID-19 assistance. For example, one important Section 7(a) resource is the Express Bridge Loan Pilot Program Guide.

The Express Bridge Loan (EBL) program isn’t new – it began as a pilot in October 2017 to provide expedited, emergency SBA-guaranteed bridge loans, up to $25,000, to small businesses located in communities affected by Presidentially-declared disasters. On March 20, the EBL was modified to directly reference COVID-19, although that revision retained the $25,000 limit.

If $25,000 seems rather paltry in the face of today’s challenges keep in mind that the recent EBL modifications preceded passage of the $2.2 trillion CARES Act, which is now poised to send a deluge of money through Section 7(a) programs. In a Section (1102) called the “Paycheck Protection Program,” for example, the new Act allows loans up to $10 million! The point is, now is the time to become familiar with SBA’s programs. The EBL guidance document is brief – just 13 pages. It’s worth looking at now for important insights regarding loan eligibility, documentation and working with a lender. Upcoming details may change but it’s to your advantage to use this time to investigate the assistance programs that SBA already has established.

Another likely funding program is the “Economic Injury Disaster Loan Program.” Current program text reads, “the SBA will work directly with state Governors to provide targeted, low-interest loans to small businesses and non-profits that have been severely impacted by the Coronavirus (COVID-19). The SBA’s Economic Injury Disaster Loan program provides small businesses with working capital loans of up to $2 million that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing.”

Again, that was written before the CARES Act. Now, decisions about process and next steps are likely changing by the hour. Remember the intent is to get money to people and businesses quickly. Be on the lookout for new SBA announcements and links as the Agency urgently works overtime to implement legislative demands.

SBA isn’t the only resource. Many business and trade associations are developing guidance to help their members expedite federal and state economic assistance.

The CARES Act specifically references that the new Payroll Protection Program loans can be used for:

- Payroll costs;

- Group health care and related insurance premiums;

- Employee compensation;

- Mortgages (but not prepayment);

- Rent;

- Utilities; and,

- Interest on “any other debt obligations that were incurred before the covered period.”

Importantly, the Act tells how a maximum loan amount will be calculated. This is somewhat formulaic but not overly complicated. It includes an average of payments during the past year, allowing separate analyses for seasonal workers and expenses. It includes outstanding loans and monthly payments. The text does require a close read – now is the time to do that. [To see the specific “Maximum Loan Amount” text, use the HR 748 link above and go to page 10 and look for paragraph (E).]

Two other important aspects for a business as these aid programs start are allowances for loan deferments and, even more significant, loan forgiveness. As presented in the bill, deferments are more straightforward than forgiveness, which, as might be expected, makes more complicated demands.

With deferment the Act takes a broad and generous approach, allowing deferment to any “impacted borrower,” meaning any loan recipient during this emergency period. The Act is clear: deferment requires lenders “to provide complete payment deferment relief for impacted borrowers with covered loans for a period of not less than 6 months, including payment of principal, interest, and fees, and not more than 1 year.”

The forgiveness provision is not as straightforward. The Act sets limits on how much can be forgiven. Limits are linked to employment and reductions in wages and salaries, also extended to tipped employees. The Act requires a separate application for forgiveness.

Implementation and subsequent steps for deferment and forgiveness are still to be determined. The bill directs the SBA to provide guidance within 30 days after the date of the bill’s passage: on or about April 28, at the latest. Again, add this to your watch list now.

Hopefully in six weeks or so the biological phase of this crisis will have peaked. Then, this huge infusion of public capital will be poised and ready to go, providing a big jolt to get America back to work. If you need some of this money, get ready now.

Tom Ewing is a freelance writer specializing in energy, environmental and related regulatory issues.