Severe congestion problems in global maritime supply chains affect everyone connected in any ways to the flow of containers. In response to the crisis, several institutional and academic experts have published a paper introducing the concept of ‘dynamic time slot management.’ They propose the use of time slots and data sharing to empower different parties to make more informed and flexible plans.

Severe congestion problems in global maritime supply chains affect everyone connected in any ways to the flow of containers. In response to the crisis, several institutional and academic experts have published a paper introducing the concept of ‘dynamic time slot management.’ They propose the use of time slots and data sharing to empower different parties to make more informed and flexible plans.

The goal is to overcome the disruptions and congestion in the supply chain system – with the understanding that improving supply chain visibility is a key element of the effort.

The authors call for an expansion of the so-called Just-in-Time arrival approach. They want to incorporate a slot management concept that includes a dynamic view and management of J-I-T arrivals and departures to better manage uncertainties.

Disruption and congestion are occurring across the global maritime supply chains. Since the summer of 2020, rising capacity shortages in terms of boxes, ships and port infrastructure have driven maritime and port actors to find alternative options and to optimize infrastructure usage. The debate about resolving the situation centers around just-in-time vessel arrival at ports. However, that only addresses part of the problem. The many operators and clients of maritime supply chains need to overcome these times of continuous shocks, disruptions and high uncertainty. This works best with a high level of visibility.

A new research paper by 11 notable authors is making the case for a fresh approach to the problem. Entitled “Improving a congested maritime supply chain with time slot management for port calls,” it proposes the use of time slots and data sharing. The authors argue that this strategy empowers the different parties to make more informed and flexible plans to overcome the disruptions and congestion in the supply chain system and improve supply chain visibility.

Is it time for an expansion of the J-I-T arrival approach? It is possible to incorporate a slot management concept that includes a dynamic view and management of J-I-T arrivals and departures to better manage uncertainties?

Insufficient Synchronization

Port congestion, poor schedule integrity and container imbalances are making headlines. The recent Ever Given incident inside the Suez Canal brought shipping to a halt, and it made the delayed arrival of cargo into a global news event. But the problems go much further and deeper. Many now see maritime supply chains as disjointed. They think that ports are insufficiently synchronized with ship journeys and with multi-modal transport capacity in the hinterland. Record high freight rates reflect the current situation in the maritime sector. With the supply chain under such intense pressure, the resulting imbalances between demand and supply have led to a surge in the prices to move containers.

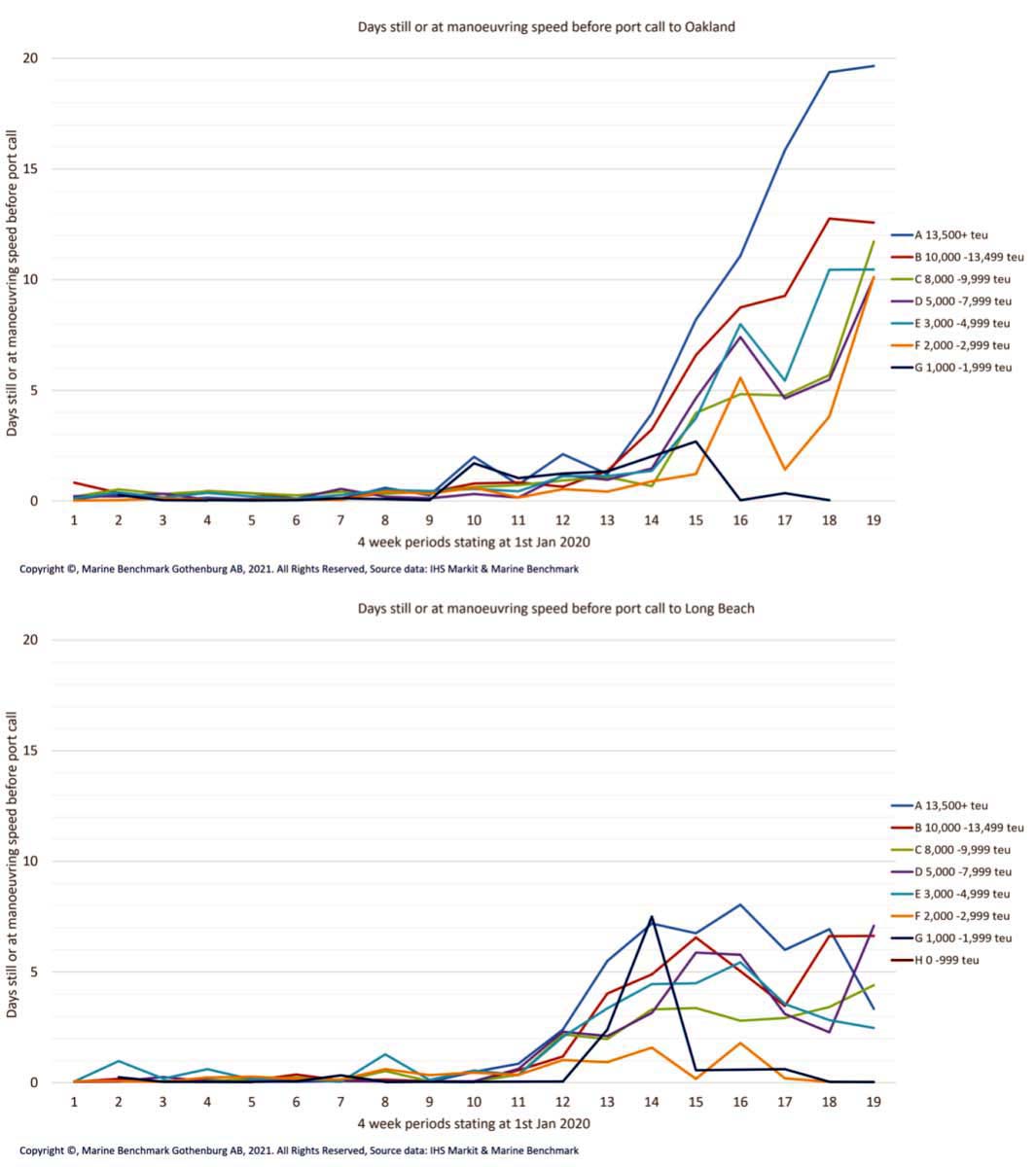

Over the last several months, growing West Coast congestion, in Long Beach and Los Angeles and Oakland, has worried customers, shipping lines, government executives, and others. These West Coast ports together handle about 40% of U.S. imports from Asia. Recently, delays at these ports have reached extraordinary levels, with some of the largest ships waiting nearly three weeks to get to berth, with obvious impacts on both import and export cargo flows.

The congestion has been blamed on shortcomings in infrastructural and resource capabilities. But the situation is more complex than that, as the reasons for constrained port infrastructure are many. For example, in the case of Oakland, it is understood that a ship (the NYK Delphinus) caught fire (in May) and was occupying a berth much longer than planned. Manning availability at the ports has also been questioned.

The main concern for supply chains is to reach higher levels of certainty throughout the chain while also capturing possibilities to reduce costs and emissions. Shipping companies as well as the clients of the maritime supply chains try to develop mitigating strategies to reduce vessel waiting times and uncertainty about when a vessel will be served by the port, such as by getting to the port area as quickly as possible or by overbooking facilities. This can be wasteful, costly and inefficient.

The fundamental underlying cause for the current delays and high freight rates is a shortage of capacity, including ships, containers, trailers, and vehicles needed for the intermodal transport operation.

The logistics industry has basically two options to get back to normal. One, it could increase the pool of equipment to have spare capacity at its disposal so that when demand surges or supply is disrupted, the extra ships, containers, vehicles, and trailers can provide the additionally required supply. Alternatively, it could introduce ways that allow the existing capacity to handle a larger volume of cargo.

In their study, the authors focus on the latter option.

Globally, congestion arising in capacity-constrained areas will continue to occur. The disruption in the container port system in southern China, like in the West Coast ports, is another recent example. Such disruptions often impact each other. Congestion tends to move from location to location along capacity-constrained supply chains. For example, congestion at West Coast ports may be temporarily relieved with less ships traveling from Asia to the U.S. But, as the constraints ease in Asia, congestion on the West Coast could re-emerge.

It is commonly assumed that ships drop anchor outside a port and sit and wait when confronted with port congestion. However, a significant number of ships waiting for a berth opt to drift or loiter outside the port instead.

For example, the port rotation from Long Beach to Oakland with a usual travelling distance of around 385 nautical miles peaked at an average travelling distance of more than 1,600 nautical miles for the larger container vessels. For rotations from Los Angeles/Long Beach to the congested zone of Oakland/San Francisco, port congestion increased the usual steaming distance by a factor of at least four.

The same trend of expanding travelling distance can also be observed for the 145 ships that conducted 322 port calls in Oakland over a 15-month period originating from Long Beach (see accompanying graphic). For ships travelling in the opposite direction (Oakland to Long Beach) in the same 15-month period the distance travelled ranged from 389 nautical miles to 425 nautical miles, inferring that Long Beach was less congested, resulting in reduced waiting times and therefore less need for anchoring outside the port and fewer ships loitering and adding unnecessary miles to the distance travelled between the two ports.

Digitization Opportunities

Long Beach and Oakland aren’t the only ports facing such a situation. The maritime sector is putting increasing focus on seeking opportunities from digitization that can enhance coordination and synchronization in the self-organized ecosystem of the maritime supply chain network.

One promising initiative is the introduction of virtual vessel arrival and standardized data exchange for just-in-time arrival promoted by numerous stakeholders associated with the maritime industry. The proposed J-I-T arrival approach makes the case that a port provides a recommended time of arrival. This approach could also help, in part, to address what is needed for the reduction of greenhouse gas emissions in the recent International Maritime Organization Global Industry Alliance’s guide on J-I-T. However, J-I-T limits itself to a port to ship interface and could result in a one-sided port view which may cause concern for shipping lines particularly during times of port congestion.

One way of avoiding this is the introduction of slot times, that could be used in an elastic way, and under conditions that all the involved parties collectively govern. When implemented in a transparent fashion, this would also give beneficial cargo owners increased visibility and greater confidence, which would lead to less uncertainties, a reduced requirement for contingency buffering and less money wasted.

Accordingly, the authors propose an expansion of the J-I-T arrival approach to incorporate a slot management concept that includes a dynamic view and management of JIT arrivals and departures. This would be informed by shared data providing up-to-date progress and planning information on queues and waiting times associated with ports as maritime chokepoints.

It would allow all participants to operate more effectively in the extensive maritime chain.

The research paper’s 11 authors include: Mikael Lind, a professor of Maritime Informatics at Chalmers, Sweden, and Senior Strategic Research Advisor at Research Institutes of Sweden (RISE); Wolfgang Lehmacher, an operating partner at services provider Anchor Group; Jan Hoffmann, head of the Trade Logistics Branch of the United Nations Conference on Trade and Development; Lars Jensen, an independent advisor and consultant at Vespucci Maritime (formerly known as SeaIntelligence Consulting); and Theo Notteboom, chair professor at the Maritime Institute of Ghent University and Professor at Antwerp Maritime Academy and University of Antwerp.

The other authors are: Torbjörn Rydbergh, founder and Managing Director of information services company Marine Benchmark; Peter Sand, Chief Shipping Analyst with the Baltic and International Maritime Council (BIMCO); Sandra Haraldson, senior researcher at RISE; Rachael White, managing director of Cool Logistics Resources and CEO of Next Level Information; Dr. Hanane Becha, the lead of the United Nations Centre for Trade Facilitation Cross Industry Supply Chain Track and Trace Project; and Patrik Berglund, CEO of shipping industry services provider Xeneta.

A Key Organization Pushing the Use of Time Slots and Data Sharing

The goal of the Smart Maritime Network (SMN) is to provide a platform to promote the benefits of enhanced integration and data sharing among stakeholders within the maritime and transport logistics sectors, informing and educating the industry on technological developments and innovations while providing wider opportunities for relationship building and knowledge sharing.

According to the SMN, achievement of this is planned through the creation of a website offering free access to relevant industry news, interviews with thought leaders, white papers and presentations outlining new technologies and processes, as well as a range of podcasts and video content, to provide a comprehensive knowledge bank on maritime innovation in the sector.

To widen the reach of the knowledge network, SMN holds a series of regional events targeted at local maritime industry stakeholders to present new ideas to key companies while addressing issues of specific local importance, communicating the overarching goal of a connected and integrated industry to a global audience.

Activities also include the creation of a Smart Maritime Council, a series of private meetings for maritime technology developers and systems integrators providing a platform for discussions on the development of a wider range of mutually beneficial partnerships, on issues relating to compatibility, standardization and harmonization.

Council meetings are planned to take place alongside SMN conferences in various locations, to provide an opportunity for a wide range of companies and their representatives to become involved.

Ultimately, according to the SMN, it’s expected that the Council would be able to drive improved collaboration in a number of areas where competition is not conducive to the best interests of the industry, and work towards the agreement of guidance notes on future regulation of maritime technologies for proposal to relevant authorities.

Shoreside Appointment & Reservation Systems

Although the concept of ‘dynamic time slot management’ isn’t commonplace for ocean carriers, appointment systems are something that other portions of the maritime supply chain have relied on for years.

For example, many terminals at major U.S. West Coast ports, including LA/Long Beach, Seattle, Tacoma and Vancouver, BC, rely on appointment systems for drayage trucks shuttling cargo containers to and from the port.

The big issue at some ports is that there isn’t an umbrella appointment system covering all terminals. For example, at the ports of LA and Long Beach, there are 12 different container terminals. The area’s drayage trucking community has expressed a desire for a single access point to make reservations or appointments, rather than having to visit 12 different companies’ websites.

Port of LA spokesman Phillip Sanfield has previously said the port’s position is that a single, front-end system, like Open Table or Expedia would allow each terminal to maintain its current reservation system and just have a single portal communicating with its system.

Regarding the trucking/distribution industry, it has used appointment systems for decades in order to alleviate congestion at warehouses. Under its system, trucks are typically given a window of about an hour or two to arrive at a warehouse. If they miss that window, they are turned away upon arrival the facility, and the shipper is subject to being fined for missing the appointment.

So if ocean carriers and their intermediaries are looking at the possibility of implementing appointment/reservation systems, they have plenty of supply chain partners that they can look to for helpful advice.